Daily Stock Market Analysis for Week 27 Tuesday- 100% Uptrend

Market moving higher, a bit extended now, needs a breather

Market Outlook and Daily Stock Updates

Note:- "Understanding the overall market trend is crucial before analyzing individual stocks. If the market is trending downward, it's unlikely that individual stocks will do well. Thus, assessing the broader market behavior is important before focusing on specific stocks. I rely on a few key indicators to gauge market trends. These indicators guide my decision on whether to invest or hold cash. I assign a percentage score to each of these indicators. The total score determines how much capital I will assign to the market."

Summary of Market Analysis

Corporate Bond (HYG) (20%)

Nasdaq 100 Power Shares (QQQ): (20%)

IBD 50 ETF (FFTY): (20%)

At least 100 New Highs Today out of 8000+ U.S. Socks: 131: (20%)

US New High Stocks Exceed New Low Stocks: 49: (20%)

Corporate Bond (HYG): (20%)

Corporate Bonds pushes higher with some volume, looks like it will pull back tomorrow, pre market is not good.

Nasdaq 100 Power Shares (QQQ): (20%)

Nasdaq is moving higher with consistent volume.

IBD 50 ETF (FFTY): (20%)

The IBD is doing well.

At least 100 New Highs Today out of 8000+ U.S. Socks: 131: (20%)

US New High Stocks Exceed New Low Stocks: 49: (20%)

Key Stocks - Stocks on Radar.

LAUR - position at 22.50

Day - 7 going in the right direction hope it breaks out to all time highs.

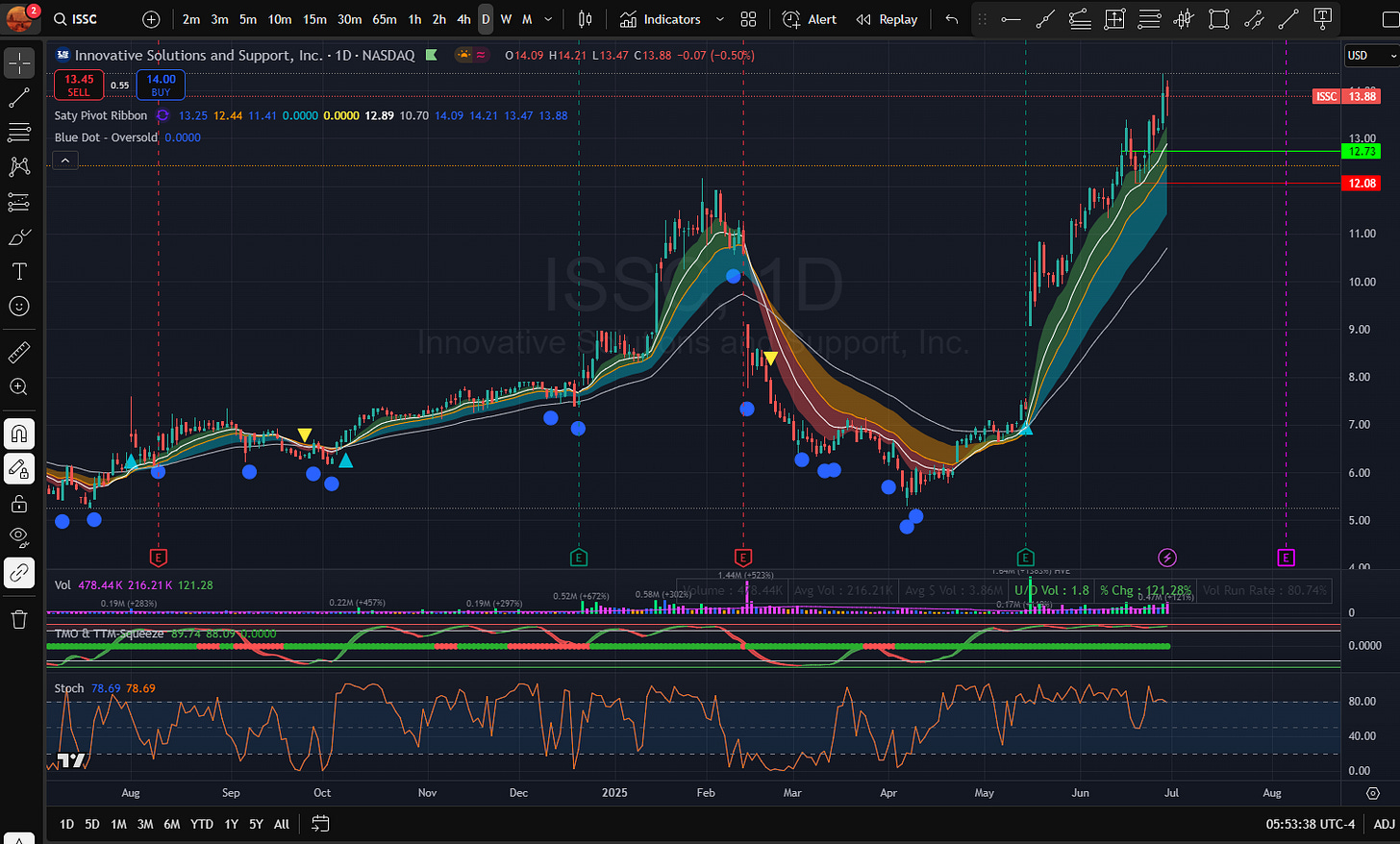

ISSC - Position at 12.70

Day 4 - Posted and inside day, not too much of a worry

SGHC - Position at 9.87

Day 4 - Inside day here as well

LASR - Position at 18.41

Day 3 - Tightening up there, may be for the up move, we will know tomorrow.

LINC - Dude, no good stopped out on this, should have noticed the loose candles, never trade these types again.

PSNL - Took position at 6.59

Pushing higher with volume, went to all-time highs, and pulled back at the end. Should have sold half but for some reason my sell didn’t get triggered.

Let's see how it acts.

RSI - Moving higher volume building up, I will look for a position with a tight stop

Disclaimer:

This newsletter is intended for educational purposes only and should not be construed as financial advice. I strongly encourage you to conduct thorough research and consult a qualified financial advisor before making investments or financial decisions.